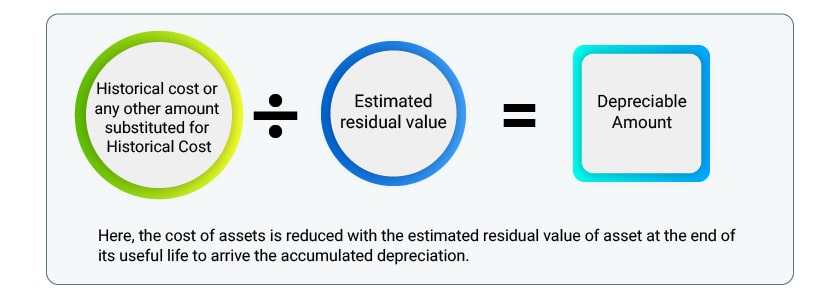

41 the formula for depreciable cost is

What is the formula for depreciable cost? - Best Acting ... The Formula for the Unit of Production Method Is Depreciation expense for a given year is calculated by dividing the original cost of the equipment less its ... Depreciable cost definition — AccountingTools Therefore, the depreciable cost of the machine is $8,000, which is calculated as follows: $10,000 Purchase price - $2,000 Salvage value = $8,000 Depreciable cost The company then uses a depreciation method, such as the straight-line method, to gradually charge the $8,000 depreciable cost to expense over the useful life of the machine.

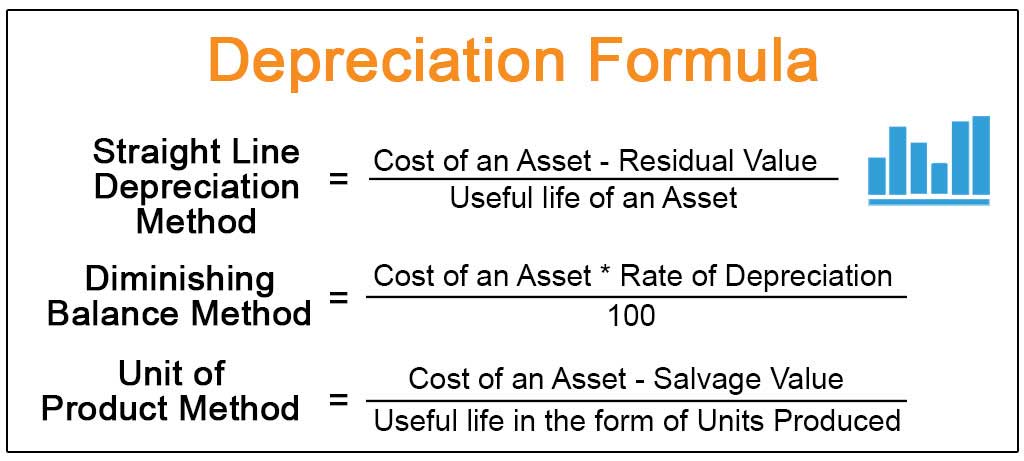

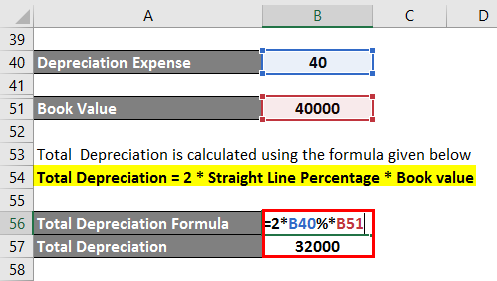

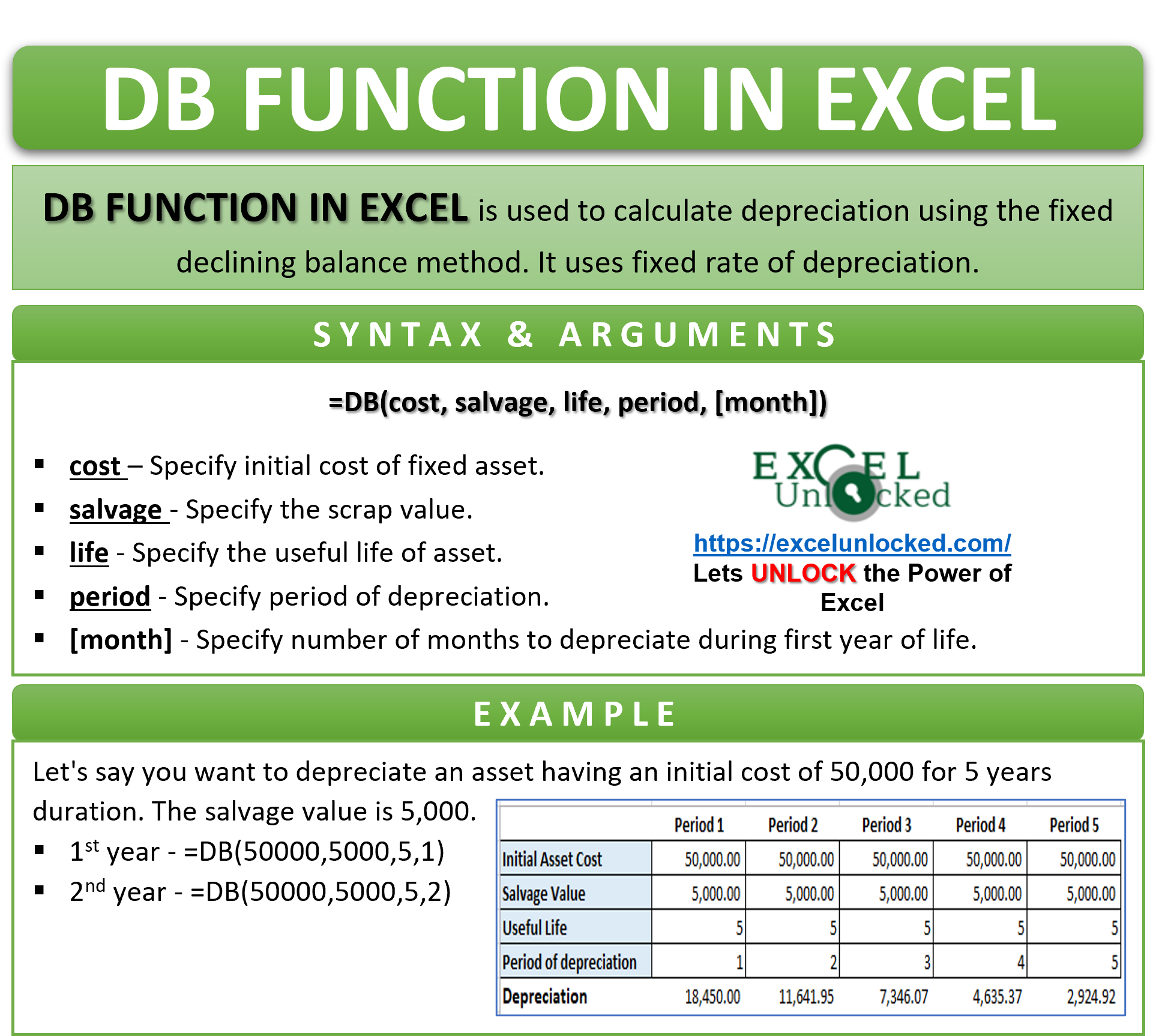

Depreciation Formula | Calculate Depreciation Expense The use of the Deprecation formula is to spread the cost of the asset over its useful life, thereby reducing the huge expense burden in a single year. Following are the importance of depreciation formula in accounting: Since depreciation is a non-cash expense, it helps the entity to reduce its tax liabilities.

The formula for depreciable cost is

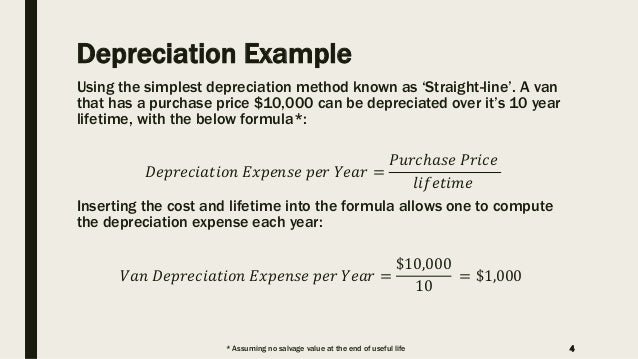

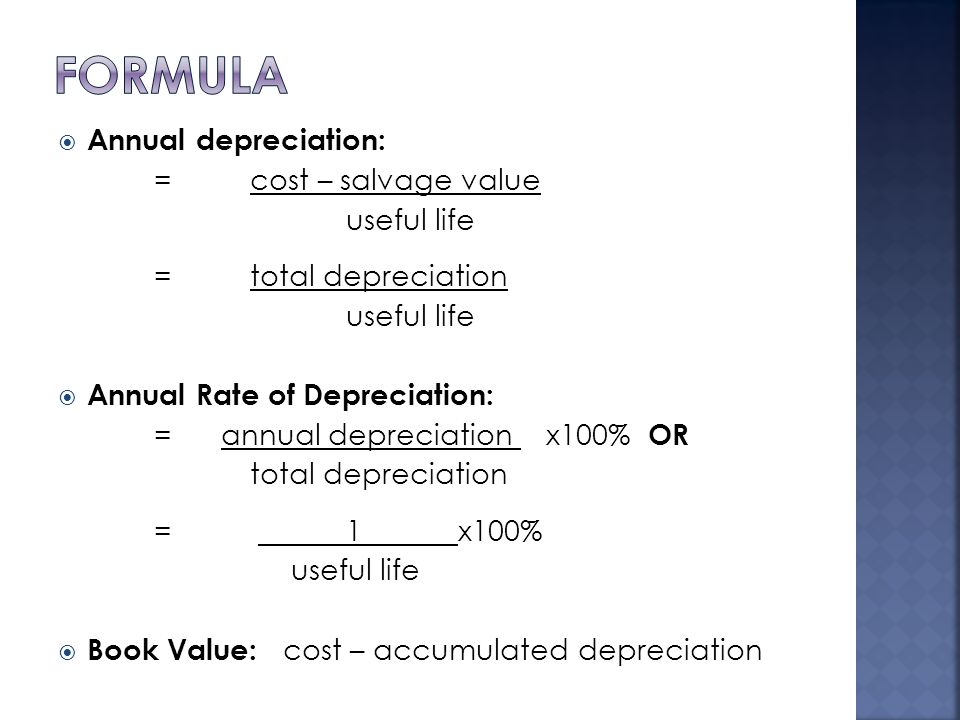

What is the formula to calculate depreciation? – Wikipedikia ... First subtract the asset's salvage value from its cost, in order to determine the amount that can be depreciated. Total depreciation = Cost - Salvage value. … Annual depreciation = Total depreciation / Useful lifespan. … Monthly depreciation = Annual deprecation / 12. … Monthly depreciation = ($1,200/5) / 12 = $20. Study 19 Terms | Accounting Chapter 9 Flashcards - Quizlet The formula for depreciable cost is a. initial cost+ residual value b. initial cost- residual value c. initial cost-accumulated depreciation d. depreciable cost= initial cost. b. initial cost-residual value. the calculation for annual depreciation using the straight-line depreciation method is Chapter 10 Flashcards | Quizlet On June 1, 2014, Aaron Company purchased equipment at a cost of $120,000 that has a depreciable cost of $90,000 and an estimated useful life of 3 years and 30,000 hours. Using straight line depreciation, calculate depreciation expense for the first year.

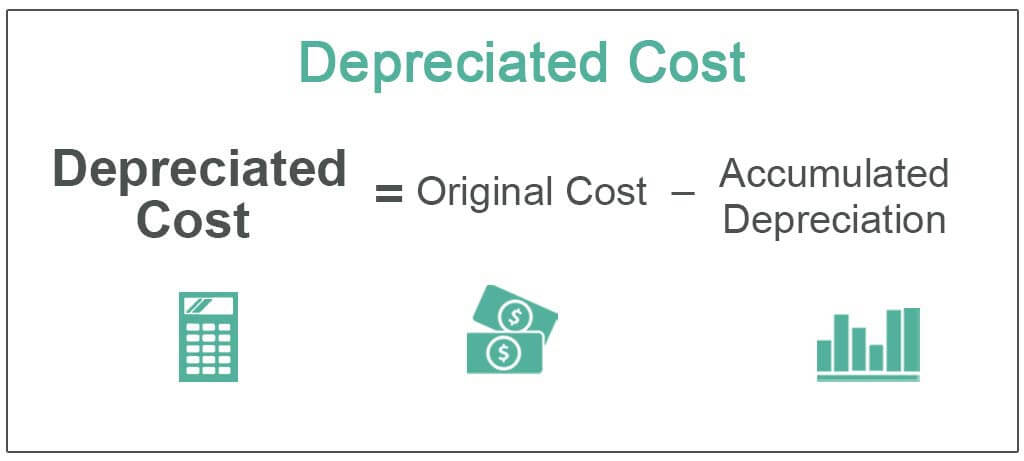

The formula for depreciable cost is. What is the formula for depreciable cost? – Greedhead.net Mar 29, 2020 · What is the formula for depreciable cost? The depreciable cost is the cost of an asset that can be depreciated over time. It is equal to acquisition cost of the asset, minus its estimated salvage value at the end of its useful life. Depreciated Cost - Overview, How To Calculate ... Thus, at the end of 2019, the accumulated depreciation is $14,250 ($4,750 * 3), and the depreciated cost is $95,750 ($110,000 - $14,250). At the end of the useful life of the asset, the accumulated depreciation will be $95,000 ($4,750 * 20). The depreciated cost will be $15,000 ($110,000 - $95,000), equal to the salvage value . Depreciated Cost Definition - Investopedia Depreciated Cost = Purchase Price (or Cost Basis) − CD where: CD = Cumulative Depreciation Example of Depreciated Cost If a construction company can sell an inoperable crane for parts at a price... (Get Answer) - The formula for depreciable cost is a ... The formula for depreciable cost is a. Initial Cost - Residual Value Ob. Initial Cost - Accumulated Depreciation Oc. Depreciable Cost = Initial Cost Od. Initial Cost + Residual Value

What is Depreciable Value? (Explanation and Example ... ABC Co. uses the following formula for depreciable value. Depreciable value = Asset's cost (acquisition cost or fair value) - Asset's salvage value. Depreciable value = $200,000 - $15,000. Depreciable value = $185,000. Conclusion. Depreciation is a method companies use to allocate an asset's cost over its useful life. ACCT CHAPTER 10 QUIZ Flashcards | Quizlet The formula for depreciable cost is a.Initial Cost - Residual Value b.Initial Cost - Accumulated Depreciation c.Depreciable Cost = Initial Cost d.Initial Cost + Residual Value. A. The natural resources of some companies include a.metal ores, copyrights, and supplies b.minerals, trademarks, and land What is the formula to calculate depreciation? - Wikipedikia ... Total depreciation = Cost - Salvage value. … Annual depreciation = Total depreciation / Useful lifespan. … Monthly depreciation = Annual deprecation / 12. … Monthly depreciation = ($1,200/5) / 12 = $20. How do you calculate depreciation per year? Determine the cost of the asset. What is a Depreciable Cost? - Definition | Meaning - My ... Straight-line depreciation is calculated by dividing the depreciable cost by the useful life of the asset. In our plant asset example, the straight-line depreciation per year would be $9,500 ($95,000 / 10 years). This means the assets recognize $9,500 of cost per year for ten years. A B C D E F G H I J K L M N O P Q R S T U V W X Y Z

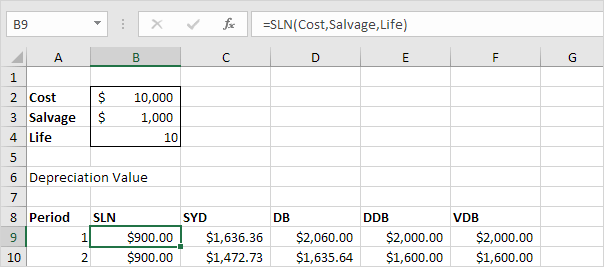

Straight Line Depreciation - Formula & Guide to Calculate The depreciation rate can also be calculated if the annual depreciation amount is known. The depreciation rate is the annual depreciation amount / total depreciable cost. In this case, the machine has a straight-line depreciation rate of $16,000 / $80,000 = 20%. Solved The formula for depreciable cost is Initial cost - Chegg Question: The formula for depreciable cost is Initial cost - Accumulated depreciation Depreciable cost = Initial cost Initial cost + Residual value Initial cost ... Solved The formula for depreciable cost is? | Chegg.com 100% (2 ratings) The formula for depreciable cost is, Depreciable cost = initial …. View the full answer. Previous question Next question. Ch 10 Quiz Flashcards | Quizlet The formula for depreciable cost is a. Initial Cost + Residual Value b. Depreciable Cost = Initial Cost c. Initial Cost - Accumulated Depreciation d. Initial Cost - Residual Value d. the units-of-activity method

The formula for depreciable cost is a depreciable - Course Hero The formula for depreciable cost is: a. Depreciable cost = initial cost. b. Initial cost + residual value. c. Initial cost - accumulated depreciation. d.

Chapter 9 Quiz Flashcards | Quizlet The formula for depreciable cost is. Initial cost - Residual value. The higher the fixed asset turnover, the. more efficiently a company is using its fixed assets in generating sales. On June 1, Scotter Company purchased equipment at a cost of $120,000 that has a depreciable cost of $90,000 and an estimated useful life of 3 years or 30,000 hours.

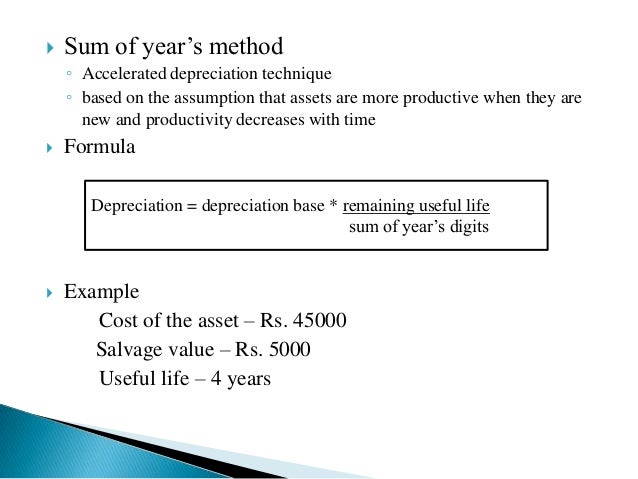

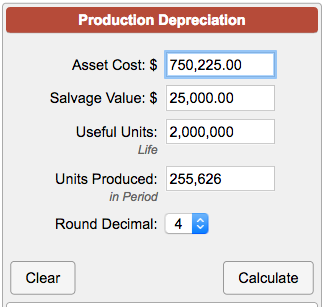

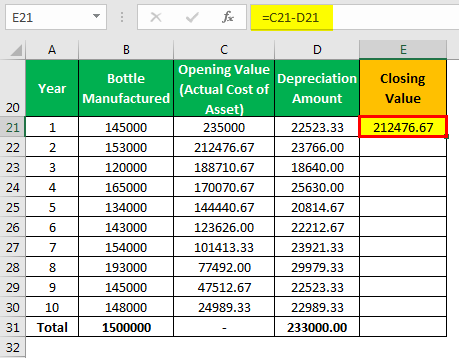

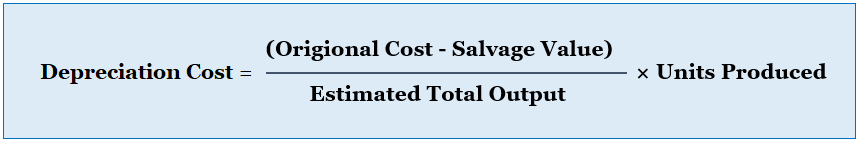

What is depreciable cost formula? – Greedhead.net Depreciation = (Asset Cost - Residual Value) / Useful Life of Asset Under the unit of production method, the formula for depreciation is expressed by dividing the difference between the asset cost and the residual value by the life-time production capacity which is then multiplied by the no. of units produced during the period.

The formula for depreciable cost is a initial cost ... The formula for depreciable cost is a initial cost residual value b initial cost | Course Hero The formula for depreciable cost is a initial cost 31.

Chapter 10 Flashcards | Quizlet On June 1, 2014, Aaron Company purchased equipment at a cost of $120,000 that has a depreciable cost of $90,000 and an estimated useful life of 3 years and 30,000 hours. Using straight line depreciation, calculate depreciation expense for the first year.

Study 19 Terms | Accounting Chapter 9 Flashcards - Quizlet The formula for depreciable cost is a. initial cost+ residual value b. initial cost- residual value c. initial cost-accumulated depreciation d. depreciable cost= initial cost. b. initial cost-residual value. the calculation for annual depreciation using the straight-line depreciation method is

What is the formula to calculate depreciation? – Wikipedikia ... First subtract the asset's salvage value from its cost, in order to determine the amount that can be depreciated. Total depreciation = Cost - Salvage value. … Annual depreciation = Total depreciation / Useful lifespan. … Monthly depreciation = Annual deprecation / 12. … Monthly depreciation = ($1,200/5) / 12 = $20.

/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)

/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

0 Response to "41 the formula for depreciable cost is"

Post a Comment